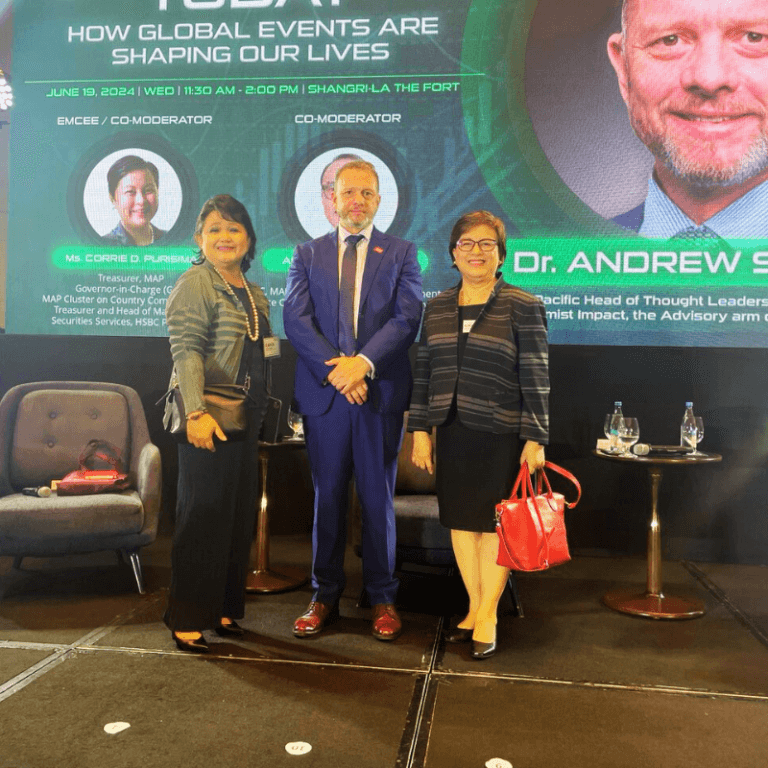

On June 20, 2024, I attended the general monthly meeting of the Management Association of the Philippines (MAP). MAP invited Dr. Andrew Staples, Asia Pacific Head of Thought Leadership and Public Policy at Economist Impact, the advisory arm of the Economist Group, who provided us with numerous insights on how current world dynamics are shaping global economies. His talk was particularly relevant given the multitude of conflicts and geopolitical tensions that seem to be escalating around the world.

Geopolitical Conflicts and Their Impact

- Ukraine-Russia War: This conflict shows no signs of abating and continues to have profound implications for regional stability and global energy markets. The protracted nature of this war not only affects the nations directly involved but also disrupts supply chains and exacerbates global inflationary pressures.

- Hamas-Israel Tensions: The risk of escalation between Hamas and Israel remains high, posing significant threats to regional peace and security. These tensions have the potential to draw in other countries in the Middle East, thus further complicating the geopolitical landscape.

- Taiwan-China and South China Sea Conflicts: The potential for conflict between Taiwan and China, coupled with disputes in the South China Sea, presents significant risks to global trade routes. The South China Sea is a critical passage for a substantial portion of the world’s maritime trade, and any disruption here could have far-reaching economic consequences.

Trade Tensions and National Elections

In addition to the above-mentioned conflicts, there are ongoing trade tensions that continue to shape global economic relations. This year, several countries, including the US, Mexico, South Africa, Brazil, Great Britain, South Korea, France, and many others, will hold their national and local elections. The outcomes of these elections could significantly impact national stability, trade policies, and international relationships. For instance, a shift towards protectionism in any major economy could lead to increased trade barriers and reduced international cooperation.

Shift in Global Power Dynamics: G7 vs. BRICS

Dr. Staples highlighted the potential shift in global power dynamics between the G7 nations and the BRICS (Brazil, Russia, India, China, and South Africa).

Enhanced BRICS Power

The rise of BRICS could lead to the establishment of alternative trade routes and investment flows, thereby reducing reliance on traditional Western-dominated financial systems. This shift could result in increased intra-BRICS trade and investment, further integrating their economies and reducing their dependency on Western markets.

BRICS nations might also push for reforms in global governance structures, advocating for more inclusive and representative decision-making processes in institutions like the United Nations and the World Trade Organization (WTO). This could lead to new international norms and rules that reflect the interests and values of emerging economies like India and South Africa.

The insights provided by Dr. Staples underscore the complexity of the current global economic landscape. Geopolitical conflicts, trade tensions, and the shifting balance of power between traditional Western powers and emerging economies are all interlinked. As we navigate these challenges, business leaders and policymakers must stay well-informed, and adaptable, and ensure their strategies are responsive to the rapidly changing global environment.

Discover how strategic insights can navigate global economic challenges with us! Explore our tailored solutions today!