In my last article, “Leading through the COVID-19 Crisis”, I had a short paragraph on managing cash if your company is in survival mode. That paragraph contained standard advice: prioritize the collection of receivables; defer payments; draw down lines of credit; work with suppliers to improve credit terms; cut projects with dubious prospects.

That advice still holds. But a couple of days ago, I moderated a webinar which took the subject of cash management many steps further than I had done, and I thought I’d share insights from that webinar with you.

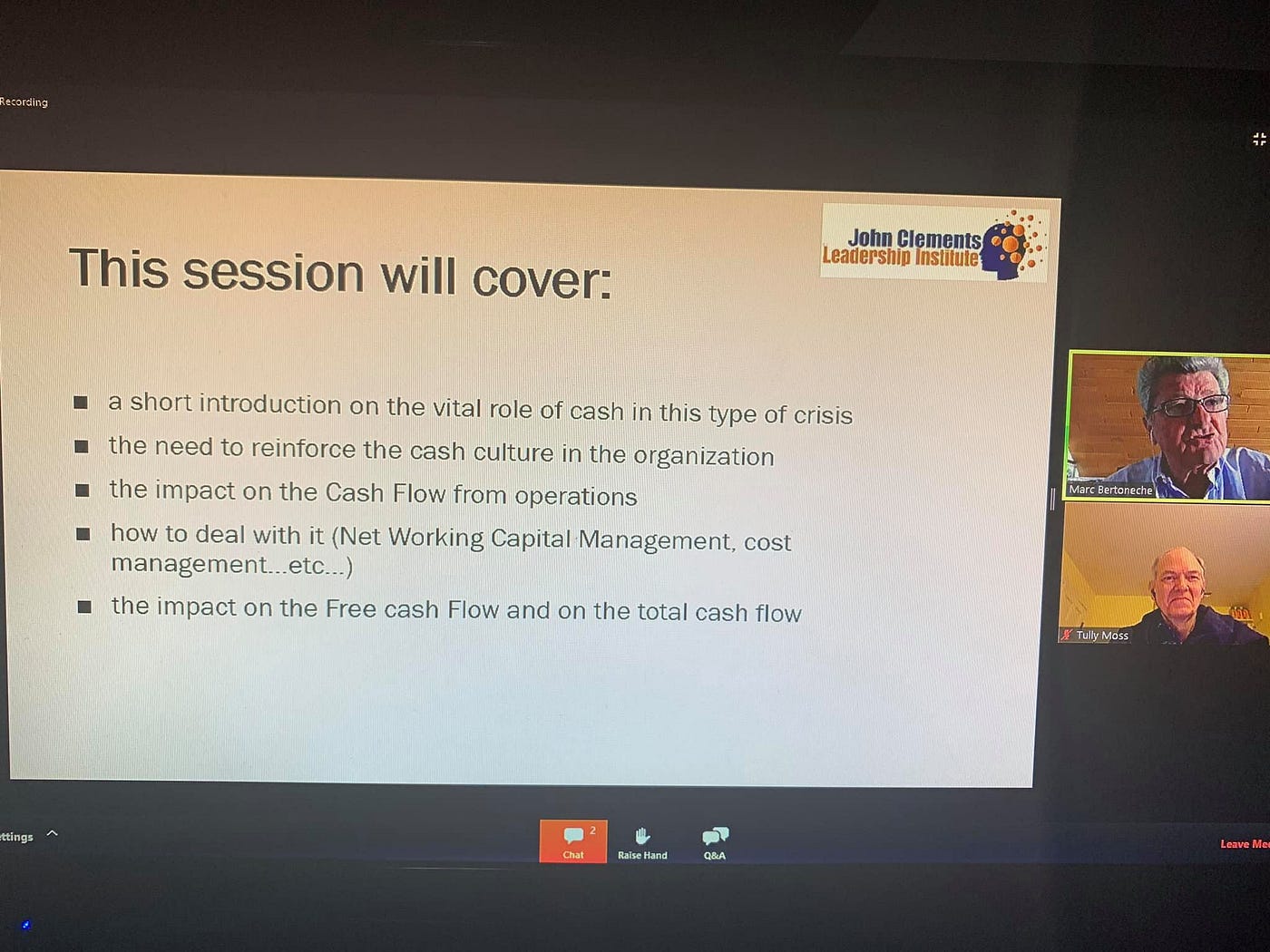

The event, entitled “Managing Cash Flow during the COVID-19 Crisis”, was sponsored by John Clements Consultants and featured an excellent talk by Professor Marc Bertoneche of Harvard Business School and the University of Bordeaux. This article summarizes Professor Bertoneche’s remarks.

With apologies if anyone with religious sensibilities would be offended, Prof. Bertoneche said that cash is no longer king: in this crisis, cash is god. In a crisis of this magnitude, with the big unknown of how long it will last, cash is crucial. It needs to be the number one priority. The name of the game is safety and survival, and cash is key to making that happen.

If cash is god, then having a cash culture is imperative. What this means is a shift of focus from the profit and loss (P&L) statement to cash flow. It means changing incentives so there is a focus on the cash culture. It means rediscovering the frugality and discipline of startups. It means having a laser-like focus on the cash burn rate.

One can acquire that laser-like focus through an ACDP mindset. “A” is for Anticipate: don’t wait; do rolling forecasts; create and test different scenarios. “C” is for Communicate: communication with all stakeholders — employees, bankers, shareholders — is critical. “D” is for Discipline: there is no longer any room for waste. “P” is for Prioritization: you can’t do everything; prioritize the essential.

Professor Bertoneche added one more acronym: EO. “E” is for Empathy: the human toll this crisis is taking is enormous, and we must do what we can to mitigate that toll, including avoiding conflicting and confusing messages that disturb people. “O” is for Optimism: avoid panic; you must communicate optimism.

Having set defined what a cash culture looks like, Professor Bertoneche advised creating a centralized cash war room. The team operating this war room would be charged with preparing for the worst by maintaining a rolling forecast of cash budgets, prioritizing payments, ensuring close reporting metrics, and optimizing cash reserves. There also should be treasury pooling structures to centralize cash.

Professor Bertoneche walked us through the elements of cash flow, beginning with a reminder that cash flow equals net profit plus depreciation plus net working capital.

In terms of net profit, he started with the revenue stream, recommending that companies look into non-traditional sources of revenue. Customers may have different needs than they had a month or two ago. Governments have needs they didn’t have a month or two ago.

That’s the revenue side of net profit. What about the cost side? Here is where most companies have been focusing and, particularly in the United States, employees have been an immediate target: furloughs, leaves of absence, and massive layoffs have been the norm. Other opportunities on the cost side that companies may be considering include converting fixed costs to variable costs — through contract manufacturing, third-party warehousing, etc.

In terms of net working capital, there was much discussion of the CCC, the cash conversion cycle. Reducing the cash impact of inventory — particularly perishable inventory — can help the CCC, but excessive cuts could have an adverse impact on customer service. In terms of accounts receivable, the old saying goes that, “Sales are a gift (to your customer) until the collection of money.” Here, timely and accurate invoicing is critical because delays can kill you. Avoid invoicing errors by stepping up quality control on the billing process. Use your bargaining power to request cash or to secure short-term payments. Analyze customer payments, and time deliveries so that those with the fastest, most reliable payment records receive their deliveries first. Although not an optimal way to proceed, given the circumstances, consider factoring or discounting procedures.

While most of his advice in effect was to get as much cash as quickly as you can, Professor Bertoneche cautioned that there may be situations where you need to back off a bit. In looking at DPO (days payable outstanding), he advised that you extend payables in an intelligent way, on a case-by-case basis. Don’t extend payables so far that you kill your suppliers: you will need them when the economy turns upward. In some cases, you may even need to accelerate payments to suppliers so they can avoid bankruptcy.

Professor Bertoneche advised that you “revisit your capex plans, very seriously and very dramatically.” He also recommended seriously considering divesting assets to generate cash, even if this means having to lease back those assets. Major R&D initiatives should be reviewed for opportunities to conserve cash. If you are in the process of making an acquisition, stop it, or, if it is difficult to halt the process, offer payment in shares rather than cash. Also pay bonuses in shares, so managers are committed to the success of the company.

On the financing side, make sure that your lines of credit are still available. Take the money when it is available, not when you need it later, when everybody needs it. Seek relief on debt covenants as soon as possible. Communicate with your shareholders, and they will understand a decision to cut dividends. Postpone share buybacks: cash is scarce. In Europe, governments are pushing this, especially for companies receiving government money. Speaking of governments, take government program money ASAP. Don’t think twice about it. It’s free lunch: these are low-cost loans. Carefully study your business interruption insurance, and check your rights. If feasible, determine if your investors remain ready to support you; if they are, raise as much equity capital as you can.

Speed is of the essence. When you see situations where your supply of cash is not enough, move quickly. Speed up your digital transformation: it will help you gain time and money.

Professor Bertoneche reminded us, “We know we are going to survive.” He advised that as we emerge from this crisis, we need to keep our new cash culture. Enterprises that realize cash is no longer king — that it is god — will find they have a world of new opportunities. New customer needs will emerge. Top talent in finance, IT, and other critical areas that has been laid off will become available. Digitization and online commerce will be accelerated, affording opportunities for those able to transform their business models.

Please visit and join the John Clements Talent Community.