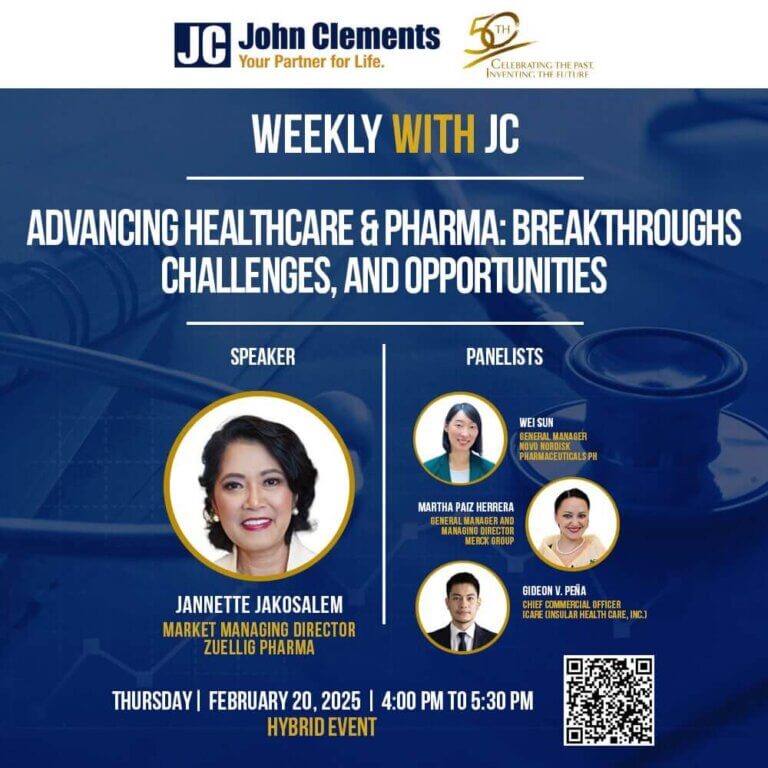

On Thursday, February 20, 2025, John Clements continued its Weekly with JC industry briefing series with a session on “Advancing Healthcare & Pharma: Breakthroughs, Challenges, and Opportunities.” This exclusive event gathered top industry leaders, including Jannette Jakosalem (Market Managing Director, Zuellig Pharma), Wei Sun (General Manager, Novo Nordisk), Martha Paiz Herrera (General Manager & Managing Director, Merck Group), and Gideon V. Peña (Chief Commercial Officer, iCare). The event provided valuable insights into the evolving pharmaceutical landscape, highlighting key takeaways on industry trends, market shifts, and future growth projections.

Market Overview & Growth Trends

The pharmaceutical industry has experienced a slowdown, with a -2.6% decline in 2024 following a robust 7% CAGR until 2023. However, market projections suggest a resurgence, with a 7.1% CAGR expected between 2023 and 2028, reaching PHP 390.8 billion by 2028.

A major contributor to the downturn is a 6.16% decrease in sales by Unilab, the largest local pharmaceutical company, which holds approximately 30% of the market. This decline primarily affected generic medicine sales, especially those losing patent protection. However, multinational pharmaceutical companies specializing in specialty drugs, such as AstraZeneca, Roche, and MSD, have demonstrated positive growth, averaging 7% and driving a 2% increase in the ethical market segment. Additionally, companies like Novo Nordisk, Novartis, and Boehringer have introduced new products, exceeding market averages and contributing to a 3.2% rise in originator drugs.

Key Industry Trends & Insights

Retail Sector: Expansion & Real Estate Play

Jannette highlighted three critical industry trends: retail expansion, hospital service development, and strengthening generic players. The retail segment continues to evolve, with store and warehouse expansions playing a crucial role in market reach. Mercury Drug remains the dominant player, commanding 30% of the retail space with over 1,300 branches across 6,000 stores. Retail growth is largely driven by conglomerate chains expanding beyond major cities, impacting small independent drugstores.

Retail collaborations are also shaping the industry. RHEA Generics has partnered with Mercury Drug to offer more affordable medicines, supporting the government’s Universal Healthcare (UHC) Law. Watsons, the official health and beauty partner of the Premier Volleyball League, and Mercury Drug’s partnership with UnionBank for a co-branded credit card highlight the sector’s innovation. Additionally, independent drugstores are increasingly collaborating with regional generic pharmaceutical companies to secure better discounts.

With significant leadership changes in major retail chains in 2024, market disruptions are expected in 2025.

Hospital Sector: Addressing Capacity Challenges

The Philippines currently has 1,351 hospitals, nearly half of which are privately owned. Of these, only 87 Department of Health-operated hospitals serve the public, and just 10% are classified as level 4 tertiary hospitals, capable of offering comprehensive healthcare services. Notably, 57 of these hospitals are located in Metro Manila, highlighting a nationwide shortage.

There is increasing investment in specialty care, particularly cancer treatment, and the strengthening of outpatient (OP) services. Hospital consolidation is accelerating, with a focus on expanding specialty care and enhancing service offerings.

Pharma Companies: Strategic Shifts Amid Challenges

Multinational pharmaceutical companies (MNCs) are prioritizing specialty drugs while streamlining sales operations. The promotion of end-of-life products is being outsourced to local companies, allowing MNCs to focus on innovation. Meanwhile, local generic and pharmaceutical companies are expanding their workforce and implementing creative direct-to-doctor promotions, incorporating multi-channel marketing strategies that leverage digital platforms.

Government Initiatives & Future Outlook

The Philippine government has increased the 2025 healthcare budget by nearly 3% compared to 2024, reinforcing its commitment to affordable healthcare. President Marcos has prioritized healthcare as a key component of economic renewal and long-term growth.

Despite the 2024 downturn, the pharmaceutical industry is poised for recovery, driven by MNCs’ focus on specialty drugs, retail expansions, and hospital sector improvements. With strategic collaborations, government support, and continued innovation, the industry is set to navigate current challenges and capitalize on emerging opportunities.

Stay Ahead in Healthcare & Pharma

The healthcare and pharma landscape is evolving rapidly, and staying informed is crucial. John Clements Consultants connects industry leaders with top talent and insights to navigate these changes.

Want to learn more or find the right experts for your organization? Contact us today.