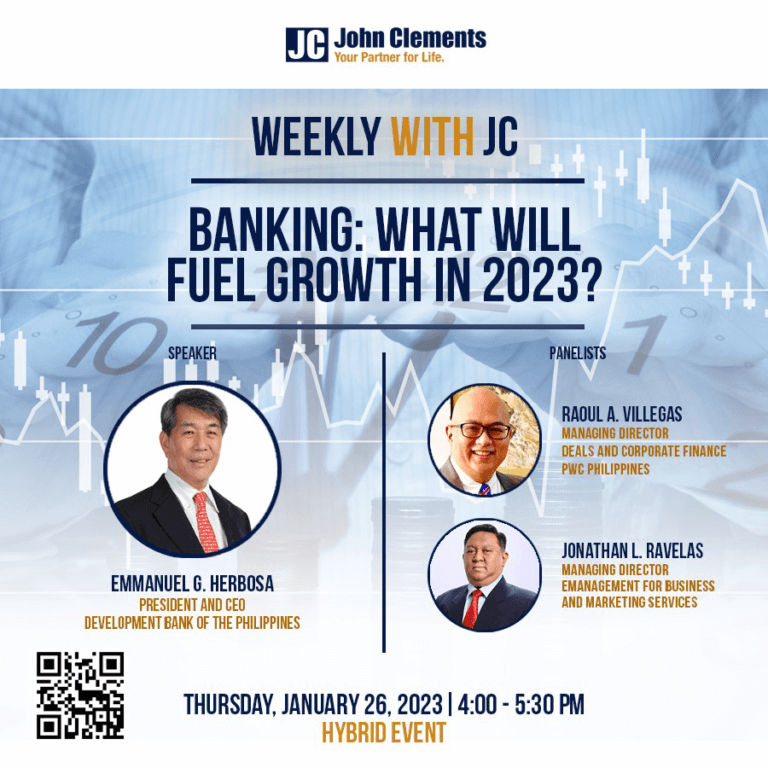

The second Weekly with JC (WWJC) event closed the month of January with a trio of lectures concerning the state of banking in the Philippines and how the country could capitalize on its recovered gains in 2023.

Emmanuel G. Herbosa, previous President and CEO of the Development Bank of the Philippines (DBP), was the event’s primary speaker, treating audiences both physical and remote, to his detailed “Banking: What Will Fuel Growth in 2023?” presentation. His segment began with updates on how loans were doing in the Philippines. Loans have a very volatile reputation in the public consciousness; borrowing money in sizable amounts that you’ll have to pay back at a designated time, often with additional interest. Beyond this perception, loans are oftentimes essential influxes of capital that individuals and businesses need to grow while indicating confidence that they can do so. This makes loans a vital component of growing economies and the banks that provide them.

So, Mr. Herbosa’s news that gross total loans in the Philippines keep going up thanks to the manufacturing, power, and retail sectors can be rather welcome. Banks in the Philippines continue to provide credit relief to borrowers, though he cautioned that interest rates have likewise been inching up. The healthiness and expansion of consumer loans is also positive, in light of 2021’s major contraction of the same. This has in turn allowed Deposits to grow both in DBP and its competitors, showcasing sustained consumer confidence and a continued appreciation of the importance of saving.

Manny Herbosa then looked towards what could be in store for banks in the Philippines and their clients in 2023. He concluded that much of this recoupment and progress was due to improved digital infrastructure in online banking, both in desktop and mobile app form. More people from across all demographics in the Philippines will be making the shift to online banking in 2023, he posits. With this in mind, the country should focus on “Digital Readiness” to make the transition easier, and prioritize cybersecurity improvements to ensure that clients are protected when they make the change. With an additional emphasis on more financial inclusion education and a plea for more Green Finance sustainability practices, he concluded his presentation.

Raoul A. Villegas, Managing Director of Deals and Corporate Finance of PwC Philippines, was kind enough to attend the event in person. From John Clements’ own LKG Tower office, he streamed his lecture. Seemingly building upon talking points discussed both by Mr. Herbosa and the previous WWJC event, Director Villegas called for more financial inclusion in the Philippines. In general, more financial literacy among the populace would help Filipinos make more informed economic choices with their banks and business practices.

This would be especially important for demographics in the agricultural areas of the Philippines; if they were to be more monetarily savvy, young people may be encouraged to stay in the provinces and develop them into new and prosperous regions rather than migrate to existing urban centers. Not to leave potential metropolitan beneficiaries out, he suggested that the country’s own telecommunications giants could stand to improve their financial literacy to develop and improve their structures and services more efficiently.

The final panelist of the evening was Jonathan L. Ravelas, managing director of eManagement for Business and Marketing Services. Infrastructure was the core topic for how the Filipino economy can potentially grow in 2023. He dug into how, despite how the Philippines has one of the fastest growing economies in South East Asia next to Vietnam, much of that is due to consumer spending rather than strides in production. The country should press its advantage to bolster its heavy industries – its fabrication and manufacturing. Buildings might be cropping up across the nations, but he reminded his audience that the nails used to hold them up are mostly from China since the Philippines has difficulty creating its own to meet demand.

Director Ravelas is appreciative and hopeful of the burgeoning foreign investment in the banks and businesses of the Philippines. However, true self-sufficiency should never be far from the minds of those living in it. A strong societal and economic constitution would not only ensure security and safety in difficult international climates but make the country more appealing to even more foreign investors. Resiliency, he posited, should be added to the Environmental, Social, & Governance (ESG) framework for sustainable and lucrative progress.

This is just an overview of these informative and expert lectures. You can stream the entire Banking: What Will Fuel Growth in 2023 WWJC event here on our Facebook page.

Elevate your knowledge about eCommerce with this week’s WWJC Event: Riding the Disruptive Wave of eCommerce. Founder of Home De Luxe Hong Kong, Diana Feng, and Panelists John Michael De Vera and Raenald De Jesus, will bring you up to speed as shopping in the Philippines gradually goes from over-the-counter to online.